LLOYDS BANK

Overview 👀

Duration: 3 Weeks

Role: User Research, UX Solutions, Wireframe and GUI Samples

Tools: Adobe XD, Figma, Spline and Illustrator

Company: Lloyds Bank

Type: Case Study – FinTech

Year: 2023

Problem 🔍

📱 Lloyds Bank app doesn’t match millennials’ and Gen Z’s banking needs.

🎯 The bank doesn’t help with saving, retirement, and insurance.

💰 Target audience struggle with understanding pensions and saving money.

💡 App lacks features and resources to support them.

🛡️ Insurance options in the app are not enough.

Project Goals 🎯

Retirement Planning: Initiating retirement plans.

Youth Savings: Motivate young savers.

Easy Goal Setting: Simplify plan creation.

Travel Insurance: Facilitate bookings.

RESEARCH

Methodology

Design Thinking 💡

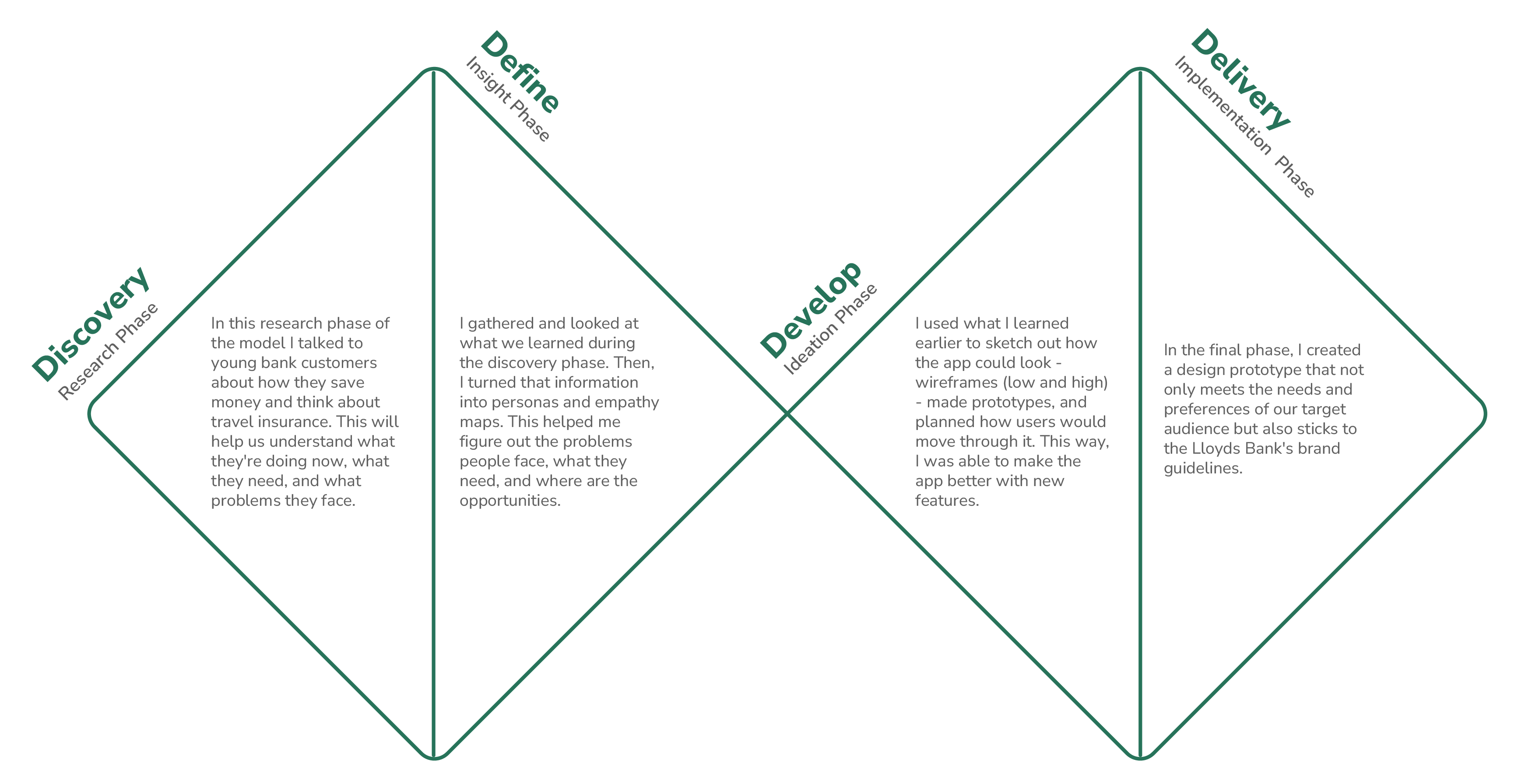

I applied the Double Diamond model to identify users and personas and develop UI/UX designs that meet the project requirements.

UCD 👤

I applied UCD by studying users, brainstorming ideas, creating prototypes, refining based on feedback, and assessing the project.

Market Research

UK’s Market Overview 🇬🇧

Thanks to the widespread use of smartphones and other mobile devices, online banking in the United Kingdom is thriving. This growth is evident in projections from Insider Intelligence, which anticipate over 35 million mobile banking users by 2024. In 2021, the UK’s online banking sector raked in £1.3 billion in revenue from fees, commissions, and interest income from lending.

According to a survey by “Which!”, Monzo, Revolut, and Atom bank are currently leading the pack when it comes to online and mobile banking services in the UK. These banks are renowned for their user-friendly interfaces, straightforward navigation, and speedy transaction processing.

News You’re Not Prepared For 🤯

About our target audience:

- Almost half (49%) of adults aged 22 to 29 had no savings or investments, with only 28% having £5,000 or more in savings or investments (UK’s Office for National Statistics, 2021).

- About 21% of employed individuals aged 18-34 didn’t know their pension value, and 24% had no clue about the amount needed for a comfy retirement (Wealth at Work, 2022).

- Roughly 11% of UK adults aged 18-24 didn’t have health insurance, which was higher than the overall adult rate (UK government’s Department of Health and Social Care, 2020).

Competitor Analysis 📊

Comparable Analysis 📈

Insights 🌟

User interface issues:

- Basic and unfriendly UI

- Lack of user-friendly data visualisations

- Less intuitive compared to other bank apps

- Easier to navigate for existing bank customers

Limited product offerings:

- Provides access to mortgage, loan, and savings products

- Fewer product alternatives compared to other banks

- Lacks a budgeting tool

Improvement opportunities:

- Enhance design with modern features

- Simplify navigation for improved user experience

- Compete with Monzo, Revolut, and Atom Bank in UI design

Cater to millennial and Gen Z users with:

- Budget tracking

- Spending analysis

- Personalised savings goals

Technological enhancements:

- Biometric authentication for quicker and more secure access

- Explore AI and machine learning for personalised financial advice

- Leverage technology to enhance user engagement and experience

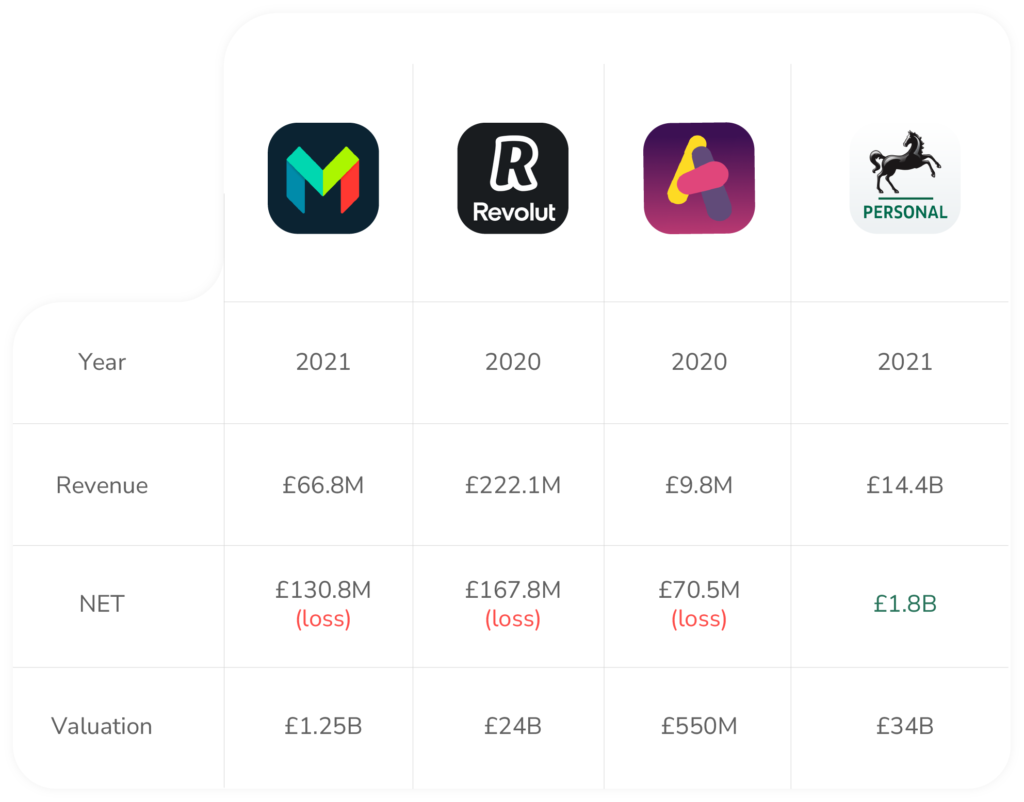

Financial data 💰

Monzo and Revolut:

- Growing revenues but significant losses

- High valuations reflect investor optimism

Atom Bank:

- Modest revenue and reported losses

- Relatively lower valuation suggests smaller scale

Lloyds Bank:

- Established with substantial revenue and profitability

- Valuation of $34B, indicating its significant presence in the traditional banking sector

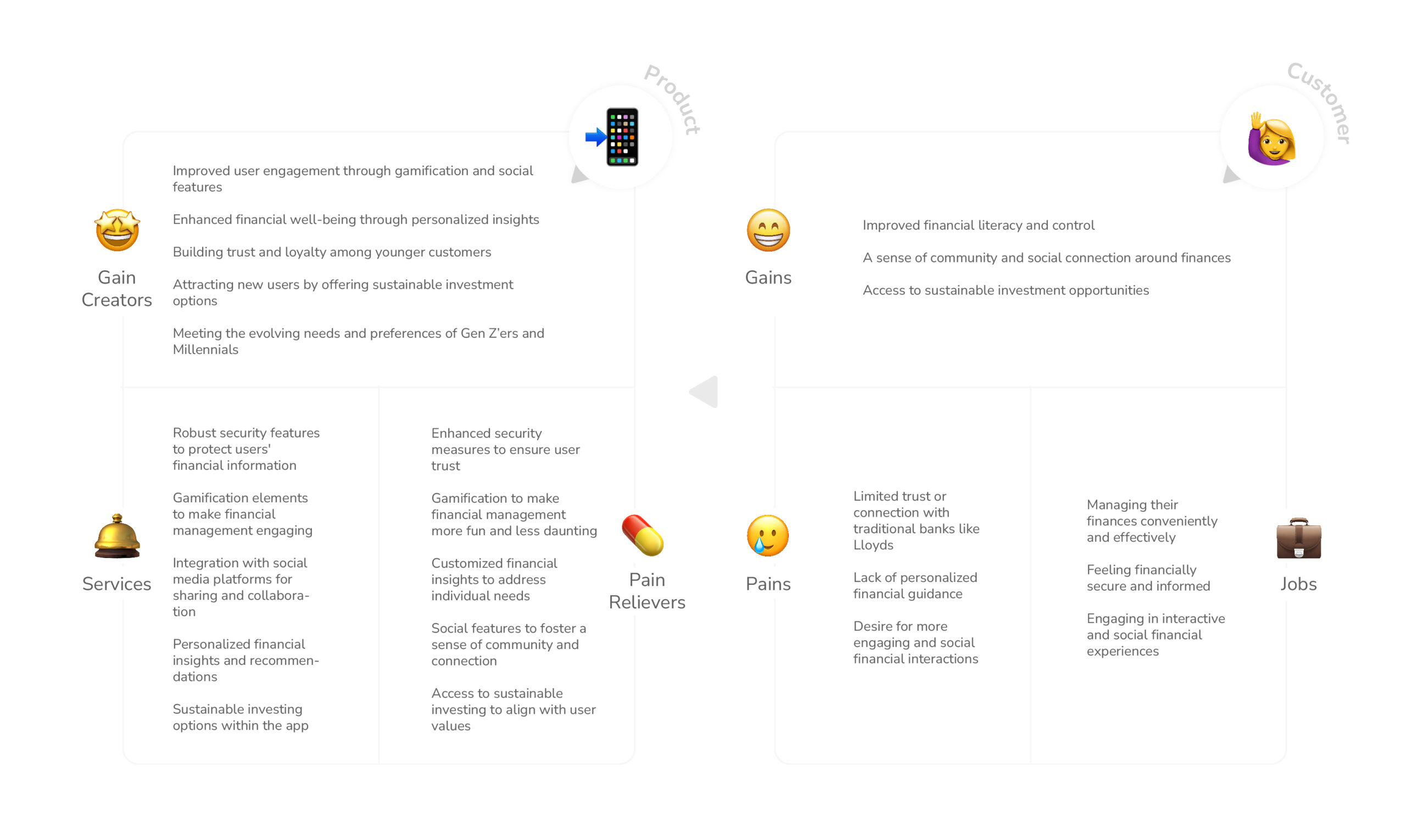

Value Proposition Canvas 🤝

User Research

Demographics 🌐

Age Group: Gen Z and Millennials (born between 1981 and 2012), with a specific focus on individuals aged 18 to 35.

Gender: Mobile banking users in the UK are fairly evenly split between genders, with females making up 53% and males 47% of the users.

Income: Mobile banking usage is distributed across all groups in the UK, highlighting that access to digital banking services is not limited by income level.

Education: A significant portion of online banking users in the UK have attained higher education, indicating that individuals with further education are more likely to use online banking services.

Location: The majority of online banking users in the UK reside in medium-sized towns and large cities, suggesting that urban centers have a higher demand for digital banking services.

Persona 😎

Callie Robbins

Bio 😇

Callie is a typical millennial. She is tech-savvy and values convenience and accessibility. She does not have kids, but wants a family in the future. Wendy has a degree in marketing and loves her work. She is a vegetarian.

Personality 🧠

She is outgoing and enjoys socialising with friends, but she also has a driven and ambitious personality when it comes to her career. She likes to stay organised and efficient in her personal and professional life.

Priorities and Goals 🎯

At the moment Callie prioritises her career and enjoys going out with friends, trying new restaurants, and travelling. Her career goal is to become a marketing manager at a larger company.

Frustration 😩

Wendy is trying to save money while still enjoying the lifestyle she loves. She also has student loans to pay off and is worried about job security in the current economy.

Challenges 🧩

She finds it difficult to stick to a budget and needs help managing her spending habits. She is also interested in investing but feels intimidated by the process.

Fears 😱

- Debt

- Losing her Job

- Afford her Lifestyle

- Changes

Assumptions 🤔

She assumes that her bank should provide her an efficient service, and she expects her banking app to be user-friendly and accessible from her smartphone.

Aesthetic 🎨

Callie values clean and minimalist design and prefers a sleek and modern aesthetic.

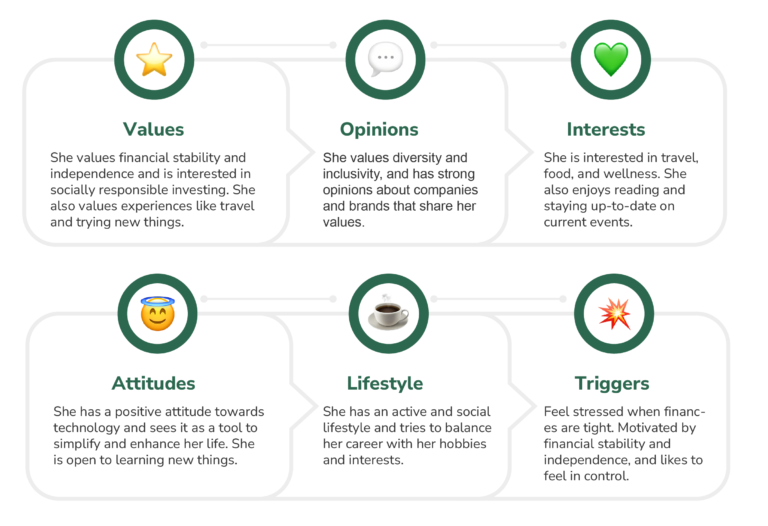

Psychographic 🧠

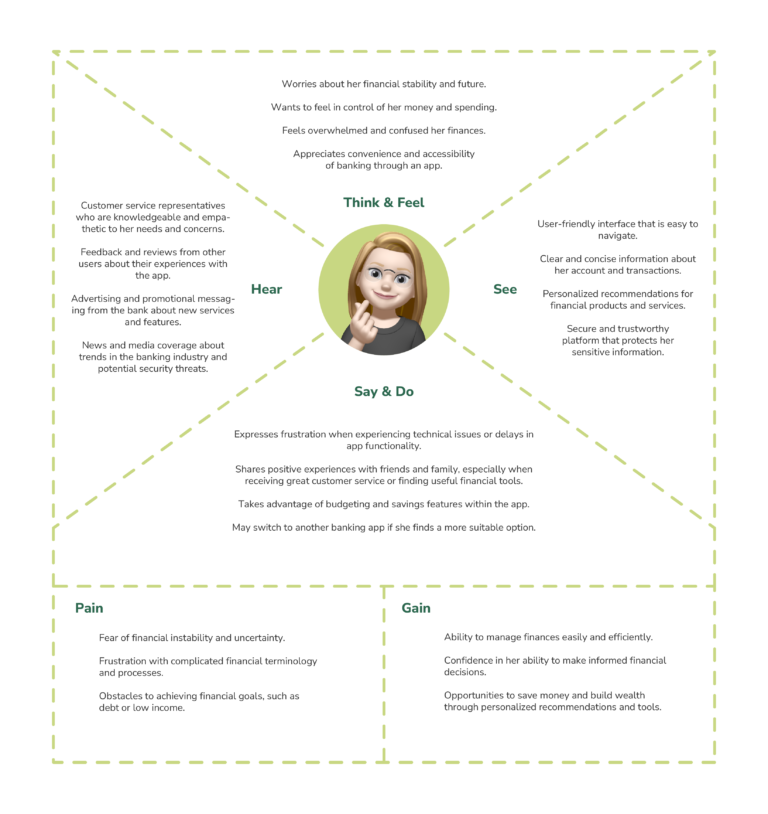

Empathy Map 🤗

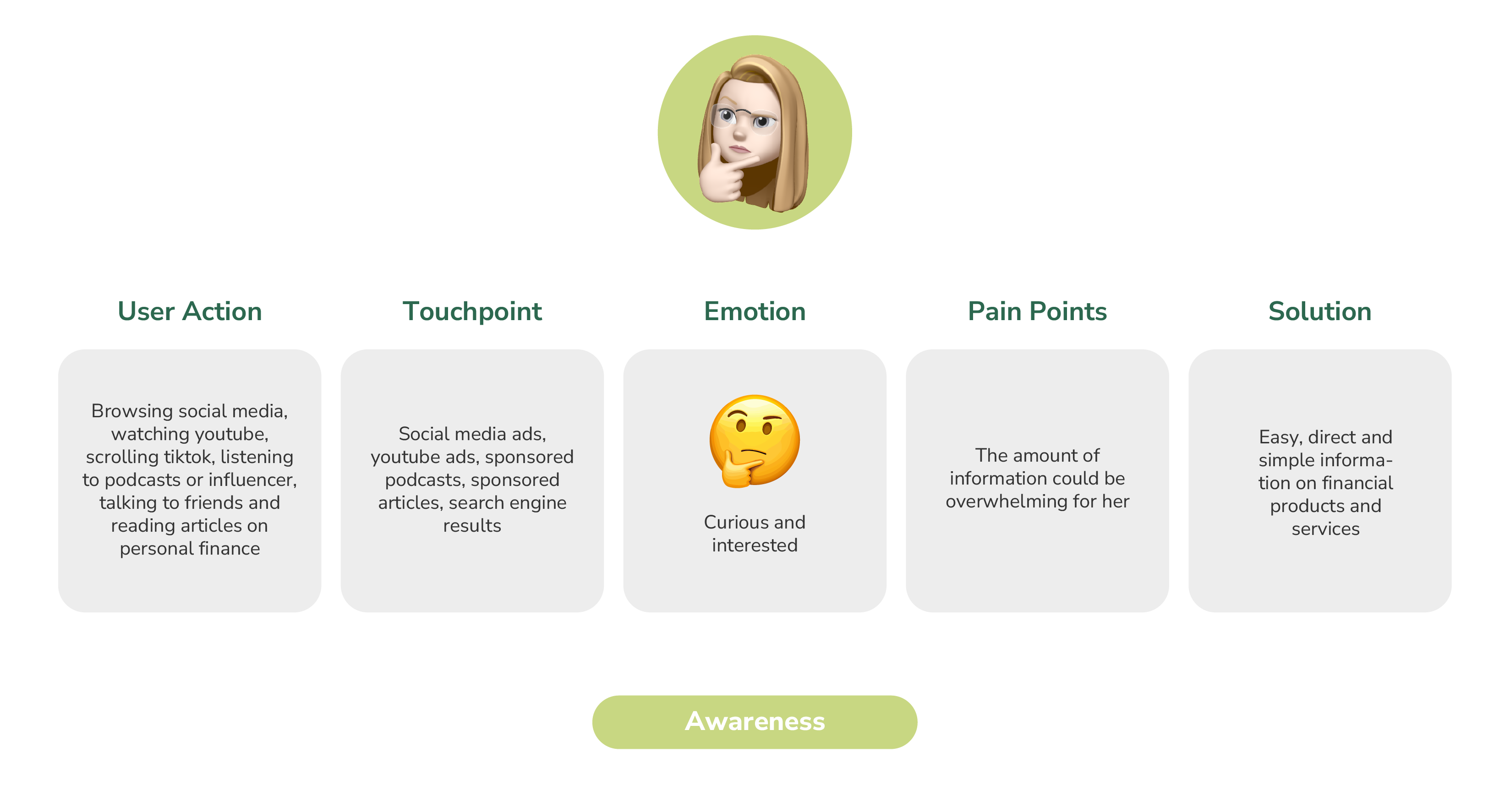

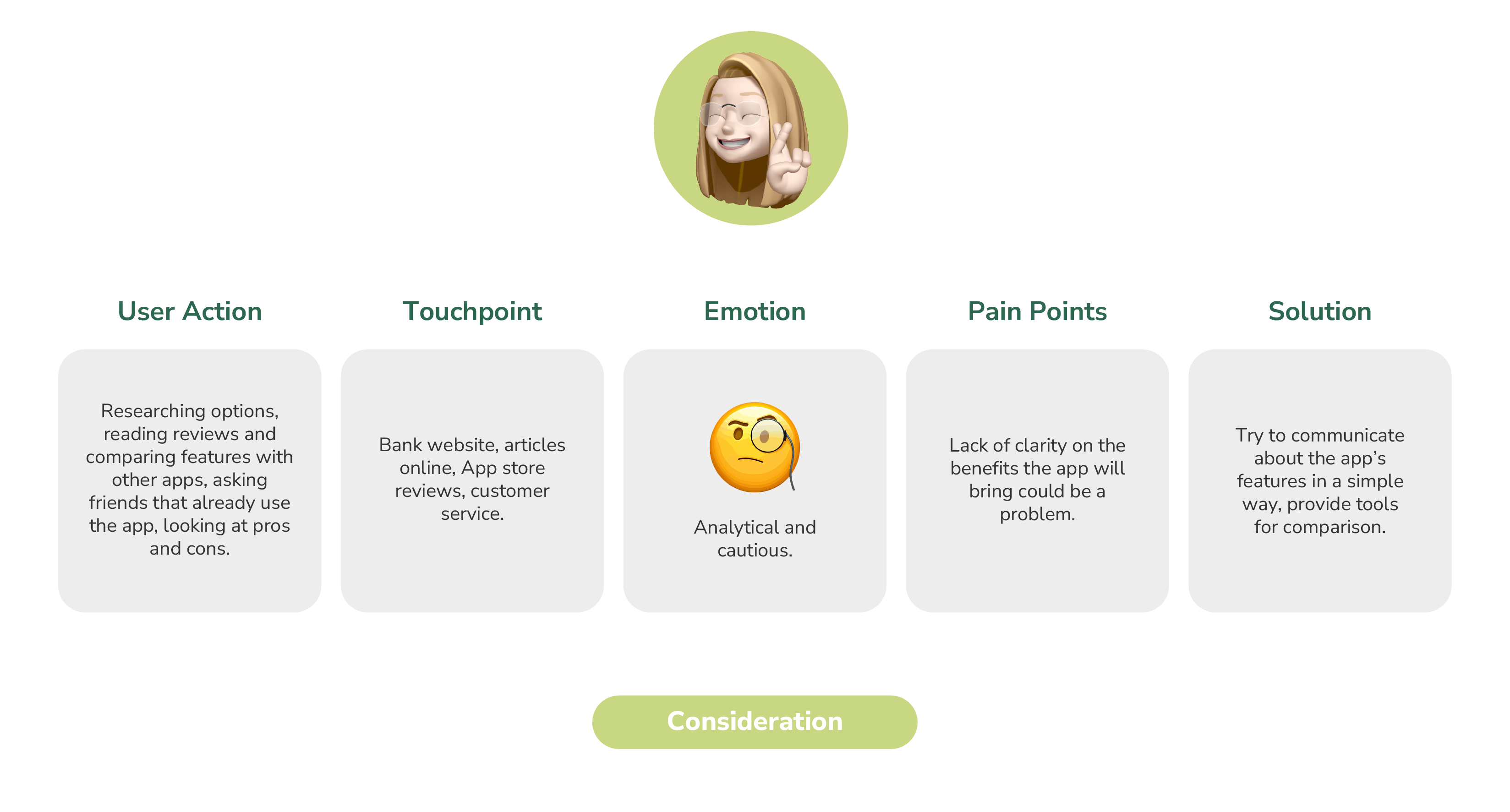

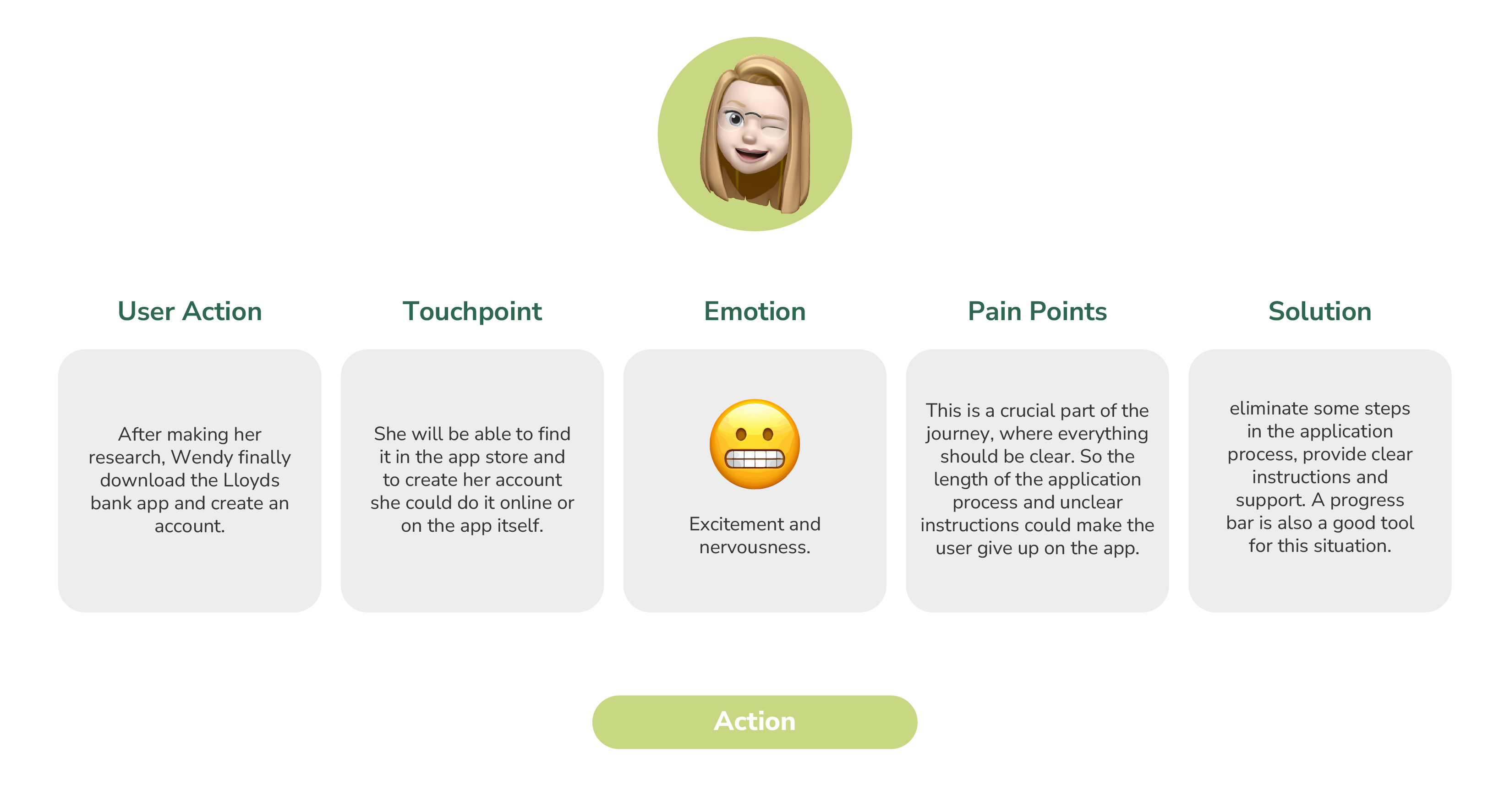

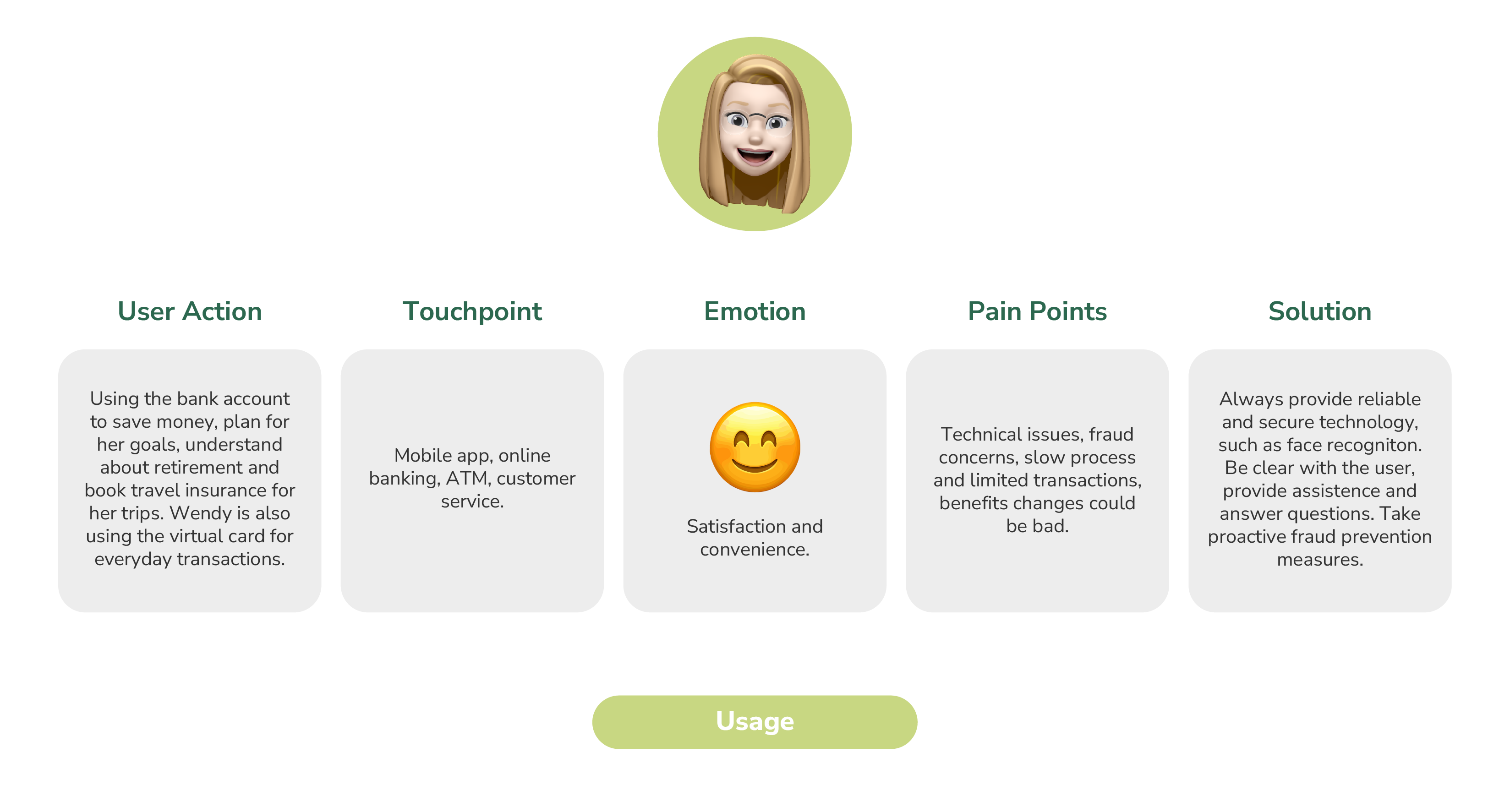

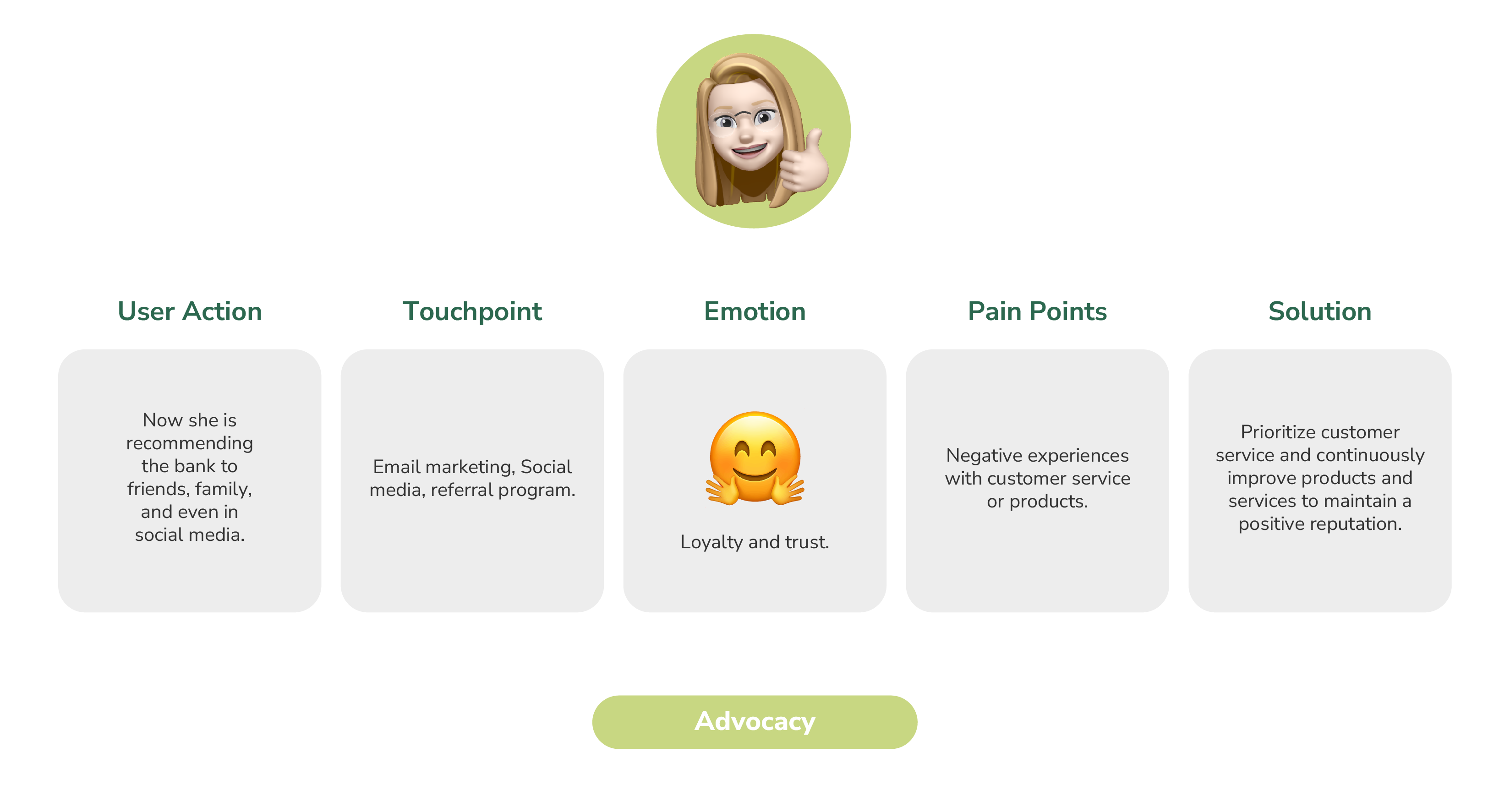

User Journey 🗺️

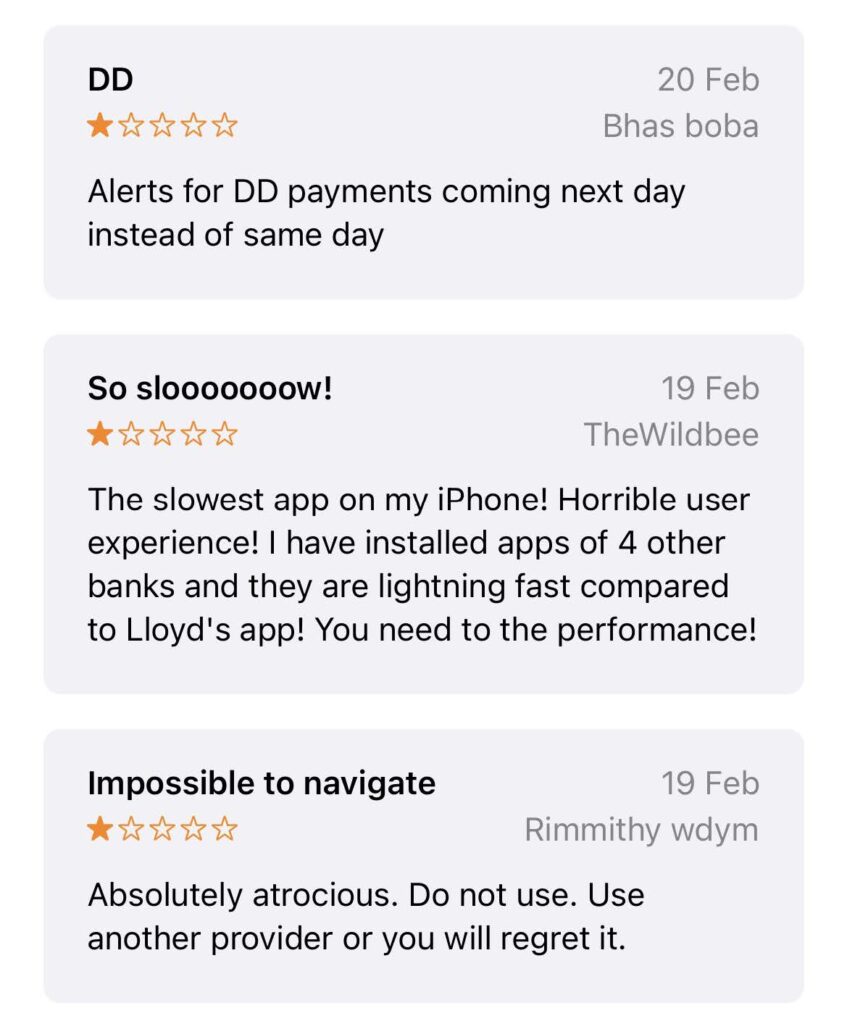

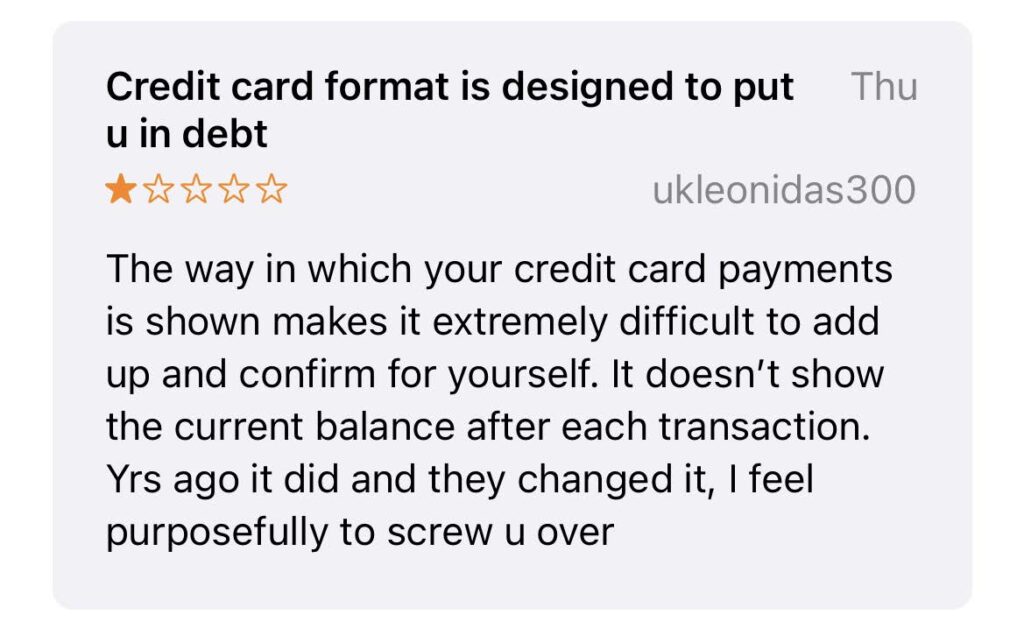

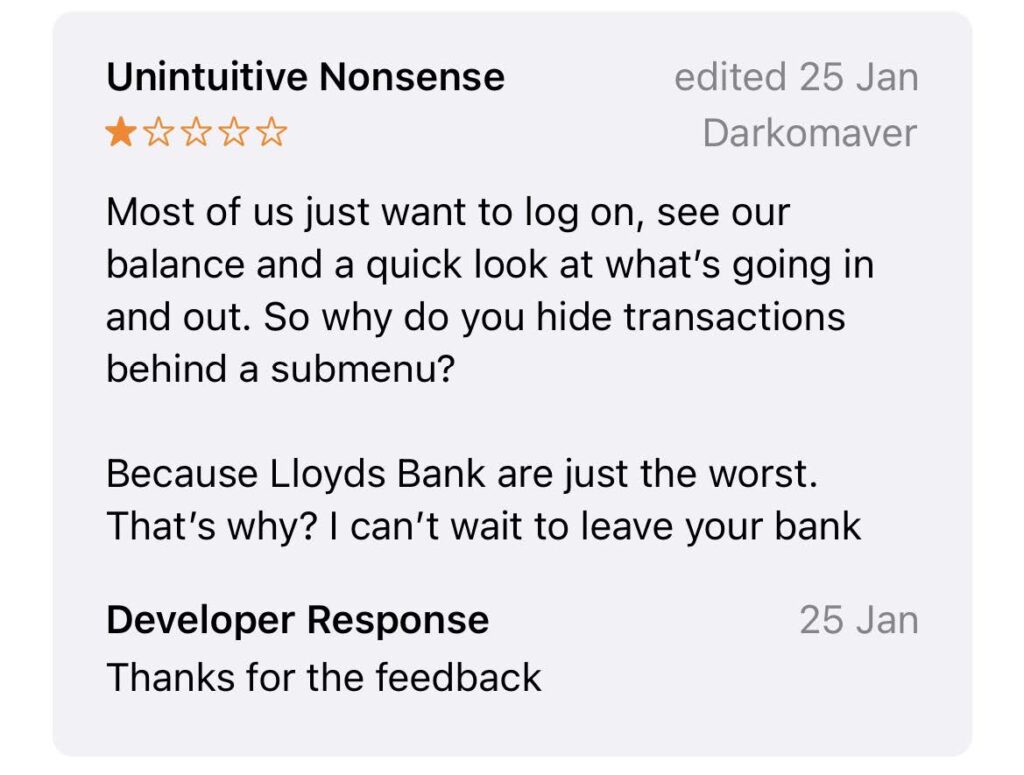

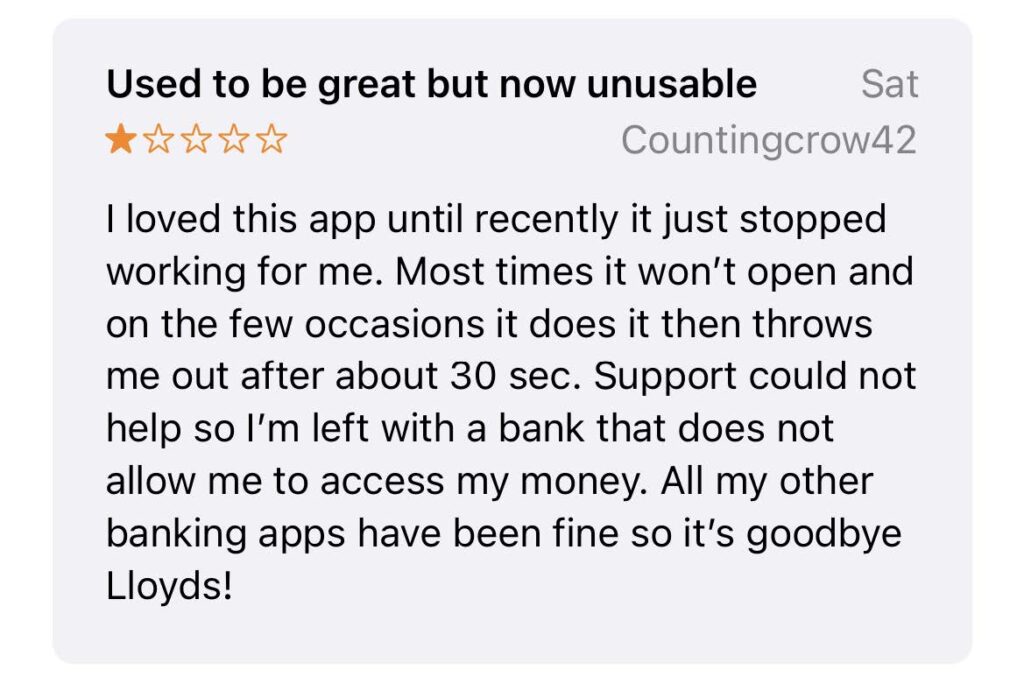

What Do They Think About The App Now? 💭

Brainstorm 🌀

THE APP

GUI

Thought 🤔

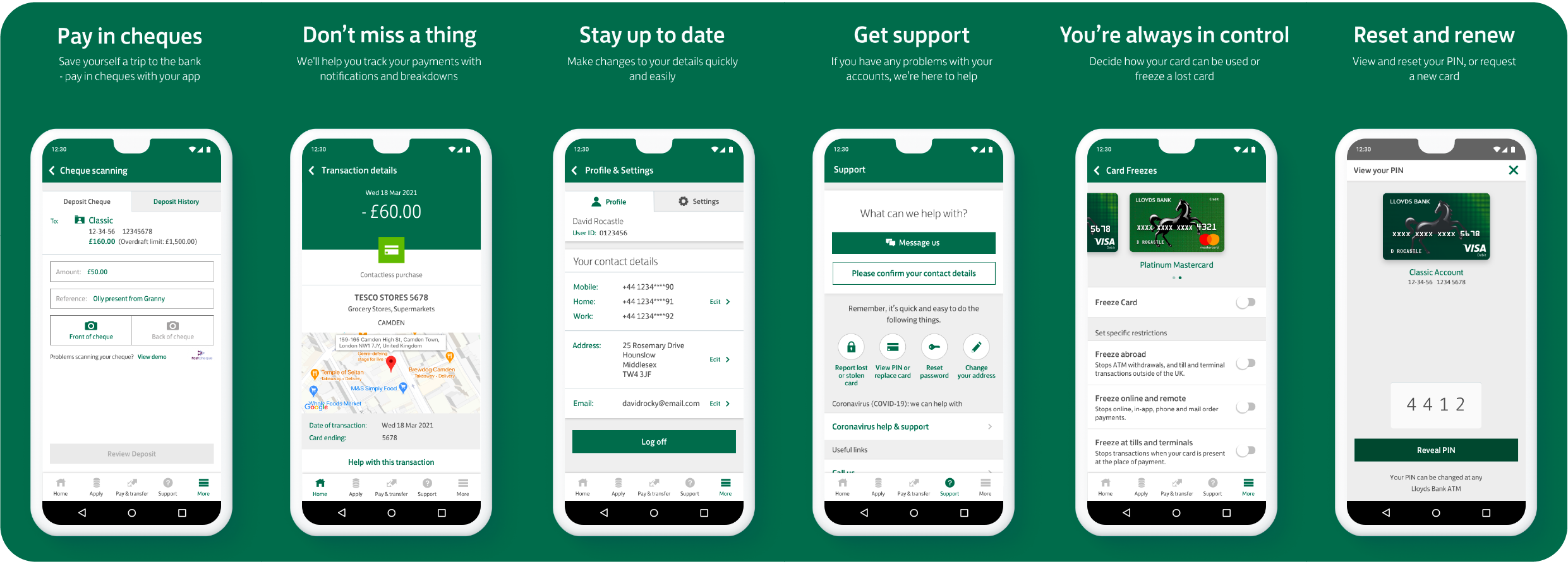

As was defined previously, the Lloyds Bank app is not as popular among young people compared to alternative banks like Monzo and Revolut. This has different causes, as was repeatedly indicated. The unfriendly Lloyds app also includes complaints regarding the customer support, user interface, size of the app, crashes, and unnecessary verification.

Solution 🔧

Redesign the UI making it easier for young adults to save money, book travel insurance, start a private pension, and plan their goals, those features will be displayed on the home screen but without removing essential features like transactions and balance. Options to pick plans and defining goals will be added, as well as a better visualisation of the vaults data.

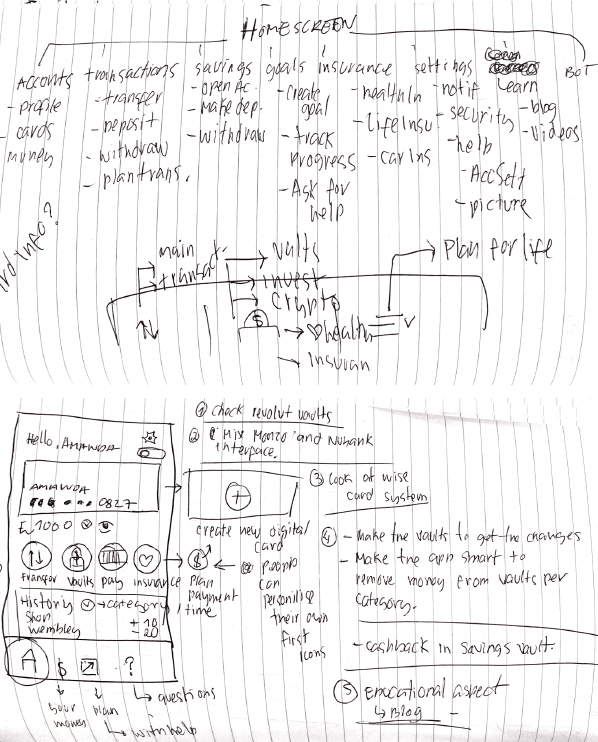

Sketch 📝

I opted to start with a paper sketch before diving into any digital tools. This approach saved me valuable time and provide me with a preliminary concept of the product’s design and functionality.

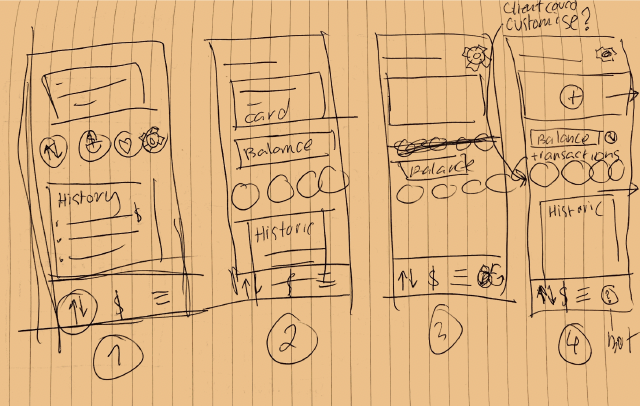

Low Fidelity Wireframe 🖋️

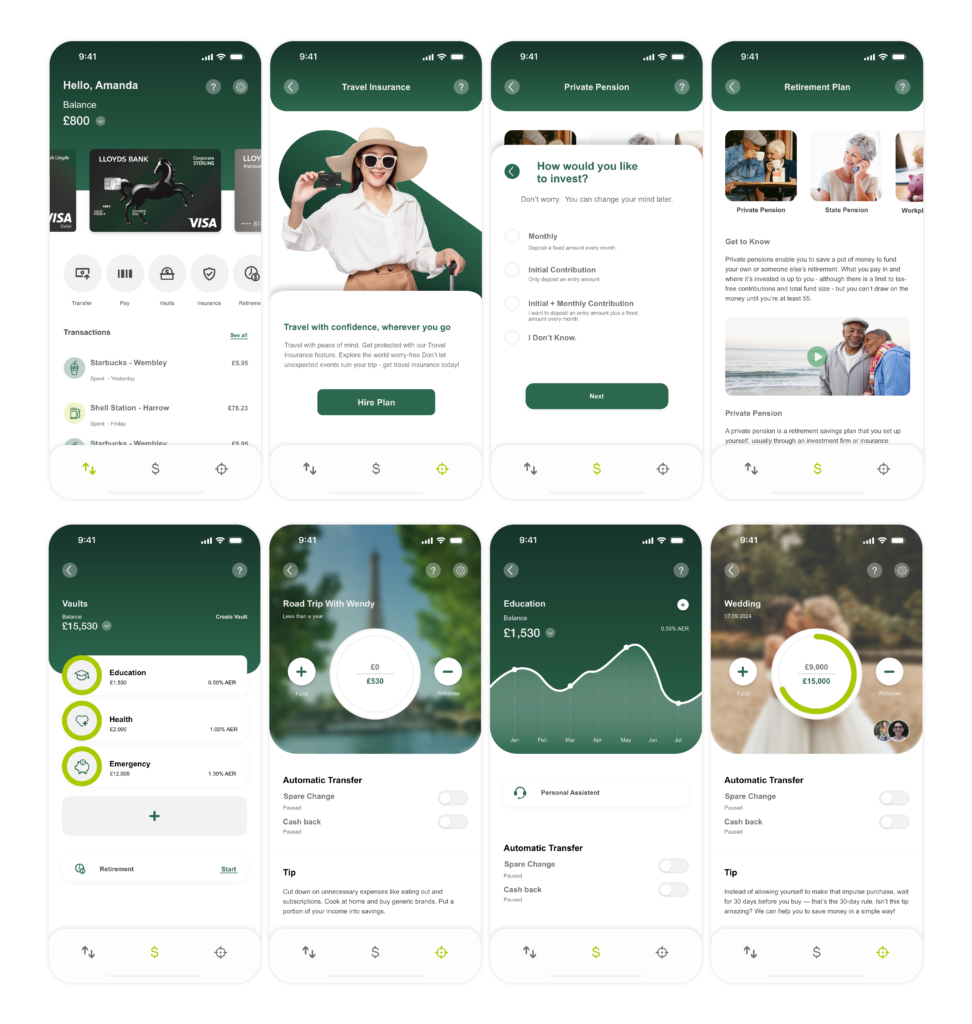

Final Product 📱

The new app maintains Lloyds Bank’s colors but adds a modern gradient to it.

The home screen offers shortcuts for retirement, insurance, and vaults, making it easy to manage finances and set goals.

The goals page includes a progress bar. Vaults and Goals feature automatic savings options like “spare change” and “cash back,” with detailed information and a chatbot for assistance.

Insurance and retirement sections provide explanations, blog links, and instant booking or questionnaire options for personalized recommendations.

Vaults Solution 🏦

The vaults feature empowers users to effortlessly create and manage separate savings compartments for various financial goals or expenses. This provides a structured approach to saving and tracking progress, all conveniently accessible from the home screen. Creating and monitoring vaults by category is straightforward, with intuitive graphics displaying your savings journey. Automated transfers, such as spare change or cash back, streamline the saving process.

Travel Insurance Solution 🏖️

The travel insurance solution simplifies coverage selection through a pre-made insurance packs like “single trip coverage”, ensuring a swift and hassle-free experience. The app also supports convenient payment options, including Apple Pay from other banks. Cardholder information is securely stored for future trips, eliminating redundant data entry.

Retirement Solution 👵

Located on the home screen, the retirement tool offers a practical approach to planning for the future. Users can define retirement age and monthly savings targets, receiving a tailored plan that optimizes their investments. A personal assistant is readily available for guidance, making retirement planning accessible and efficient.

Goals Solution 🎯

Similar to vaults, the goal solution focuses on short-term savings with a personal touch. Whether it’s planning a trip or collaborating with friends, users can create and customise their goals with images and personalisation. Pre-set goals are available for added convenience. This feature encourages goal-oriented savings with a user-friendly interface.

Conclusion

As we dive into the redesigned Lloyds Bank app, it becomes evident that significant improvements have been made across the board. From enhanced data visualisation to the introduction of pots and jars, along with convenient automatic savings features and a more intuitive button layout, the focus here is squarely on delivering a user-centered experience.

What’s truly exciting about these changes is the extensive research made, and the fact that these enhancements make the app more appealing, personalised, and user-friendly for the younger generation.